Interactive projector market size and forecast 2026-2030

- Why interactive projection matters for experience-led businesses (interactive projector market)

- Executive summary and headline forecast for the interactive projector market

- Market drivers: what is accelerating demand for interactive projector market solutions?

- Market segmentation and where interactive projectors fit (interactive projector market)

- How much of the projector market is interactive?

- Methodology: how we built the 2026–2030 interactive projector market forecast

- Forecast table: interactive projector market size 2026–2030 (two scenarios)

- Comparative view: interactive projectors vs overall projector market (interactive projector market)

- Regional dynamics and go-to-market implications for suppliers

- Cost structure, ASP trends and how they affect market value

- Mantong Digital — supplier profile and strategic fit (interactive projector market)

- How to evaluate an interactive projector project: checklist for buyers and integrators

- Risks, uncertainties and sensitivity of the forecast (interactive projector market)

- Practical recommendations for stakeholders in the interactive projector market

- Final thought

- Frequently Asked Questions (FAQ) — interactive projector market 2026–2030

- 1. What is the difference between an interactive projector and an interactive flat panel?

- 2. How fast is the interactive projector market expected to grow 2026–2030?

- 3. Which industries will adopt interactive projection most quickly?

- 4. What is the total cost of ownership (TCO) components for an interactive projector installation?

- 5. Should buyers prioritize short-throw or ultra-short-throw interactive projectors?

- 6. How can I find an interactive projector supplier with system integration and content expertise?

- Contact, partnership and product inquiry

- References and data sources

Why interactive projection matters for experience-led businesses (interactive projector market)

The interactive projector market is moving from a niche education and meeting-room tool to a multi-sector enabler of immersive retail, entertainment, exhibitions and smart public spaces. This article synthesizes available market data, industry trends and use-case economics to estimate the interactive projector market size and provide a transparent forecast for 2026–2030. The goal is to give procurement managers, integrators, investors and product teams a pragmatic, evidence-based view they can act on.

Executive summary and headline forecast for the interactive projector market

Short version: based on a synthesis of projector industry reports, growth in immersive and interactive experiences, and adoption trends in education and commercial signage, the global interactive projector market is forecast to grow across 2026–2030. We present two scenarios (conservative and optimistic) with clear assumptions so readers can test sensitivity to adoption rates and pricing erosion.

Market drivers: what is accelerating demand for interactive projector market solutions?

Understanding growth drivers is essential to interpreting any forecast. The following factors are driving the interactive projector market:

- Education recovery and classroom interactivity: Hybrid and active-learning models continue to push schools and universities toward interactive displays and projectors for collaborative teaching.

- Retail and experiential marketing: Brands invest in interactive projection to create memorable, low-footprint campaigns that blend physical and digital engagement.

- Live events and projection shows: Advances in brightness, mapping software and portable systems make interactive projection attractive for temporary installations and tours.

- Cost and flexibility vs fixed displays: Projectors can provide very large-scale visuals at lower cost than equivalent LED walls, especially for curved surfaces and temporary events.

- Software & sensors improvements: Better detection (camera, LiDAR), easier content management and cloud integration lower implementation complexity.

These drivers combine to increase both unit shipments (especially portable and short-throw interactive models) and total system spend (software + services + installation).

Market segmentation and where interactive projectors fit (interactive projector market)

To estimate size and growth, segment the addressable market:

- By application: Education, corporate collaboration, retail/brand experiences, entertainment/attractions, public spaces/wayfinding, and projection mapping shows.

- By product: Short-throw interactive projectors, ultra-short-throw (UST) interactive models, portable projectors with interactive kits, and high-brightness projection mapping hardware.

- By region: Asia-Pacific (fastest adoption), North America (large installed base in corporate/education), Europe (regulations and cultural projects), Rest of World.

How much of the projector market is interactive?

Interactive projectors are a subset of the broader digital projector market. Industry reports indicate the overall projector market is multi-billion USD in size; interactive models typically represent a single-digit to low-double-digit percentage of the total projector units today but are growing faster than the baseline market because of specialized applications. The remainder of this analysis explicitly models that share and growth differential.

Methodology: how we built the 2026–2030 interactive projector market forecast

Forecasting in an emerging subsegment requires transparent assumptions. Our approach:

- Start from published estimates of the global projector market (established industry research firms and market databases).

- Estimate the interactive projector share in the installed base using product release cycles, vendor portfolios, and adoption in key verticals (education, retail, events).

- Apply differentiated CAGRs for the interactive subsegment versus overall projector market to account for faster software-driven adoption and higher service content.

- Present two scenarios (conservative and optimistic) rather than a single point forecast.

- Show sensitivity to key variables: price decline (LED/Laser cost curve), unit adoption rates in education/retail, and the expansion of projection mapping for public art and events.

Numbers below are presented in USD billions and are rounded to two or three significant digits where appropriate. Sources for starting market sizes and trend evidence are provided in the references section so readers can verify inputs.

Forecast table: interactive projector market size 2026–2030 (two scenarios)

| Year | Conservative scenario (CAGR ~7%) USD billions | Optimistic scenario (CAGR ~12%) USD billions |

|---|---|---|

| 2026 | 0.535 | 0.560 |

| 2027 | 0.572 | 0.627 |

| 2028 | 0.612 | 0.702 |

| 2029 | 0.655 | 0.787 |

| 2030 | 0.701 | 0.882 |

Notes: The conservative scenario assumes moderate adoption and some price erosion but continued attachment of software/services. The optimistic scenario assumes faster adoption in education and retail, growth in projection mapping, and a higher ASP (average selling price) retention due to bundled software and service contracts.

Comparative view: interactive projectors vs overall projector market (interactive projector market)

To put the subsegment in perspective, we compare share and growth rates:

| Metric | Overall projector market (example baseline) | Interactive projector subsegment (our estimate) |

|---|---|---|

| Estimated 2025 market size (USD) | ~3.5 billion (baseline industry reports) | ~0.50 billion (≈12–15% share) |

| Estimated CAGR 2026–2030 | ~4–6% (market average) | ~7–12% (faster growth) |

| Main growth drivers | Corporate AV refresh, cinema, enterprise | Education, retail experiences, projection mapping, events |

Readers should treat the 2025 baseline as an informed synthesis of available market publications; the important takeaway is the subsegment growing at a High Quality to the overall market due to higher software and service attachment rates.

Regional dynamics and go-to-market implications for suppliers

Regionally, Asia-Pacific (China, India, Southeast Asia) shows the fastest growth in unit demand driven by education investments and experiential retail. North America remains strong for corporate and higher-education adoption. Europe combines cultural/heritage projection mapping projects with public-sector installations.

For suppliers and integrators targeting the interactive projector market, practical recommendations:

- Offer bundled software and managed content services — this increases recurring revenue and protects ASP.

- Focus on UST (ultra-short-throw) and short-throw models for classrooms and retail, and offer modular mapping kits for events.

- Invest in regional partner networks — local integrators reduce installation friction for complex mapping and multi-projection setups.

- Provide clear ROI case studies for education (student outcomes, utilization rates) and retail (dwell time, conversions).

Cost structure, ASP trends and how they affect market value

Interactive projectors combine hardware, optics (laser/LED), sensor modules (cameras, IR/LiDAR), and software licensing. ASP trends depend on the balance between cheaper LED optics and higher-value features (interactive sensors, mapping software). Two opposing pressures act on market value:

- Downward pressure: LED/laser module commoditization lowers unit price per lumen.

- Upward pressure: Software, calibration services, content creation and multi-projector synchronization increase total system value.

Therefore, suppliers that productize services and software can maintain or expand market revenue even if pure hardware prices decline.

Mantong Digital — supplier profile and strategic fit (interactive projector market)

Mantong Digital is a one-stop interactive projection solution provider and direct manufacturer based in Guangzhou, China, with over 10 years of industry experience. Mantong supplies hardware and software and specializes in customized solutions across immersive projection, interactive floor projection, interactive wall projection, interactive projection games, projection shows, interactive projection mapping, 3D projection and immersive rooms.

Key Mantong competitive advantages:

- Vertical integration: Direct manufacturing reduces cost and lead time for customized projection systems.

- End-to-end capability: Hardware + software + content + installation services allow Mantong to sell bundled solutions with higher recurring revenue potential.

- Experience in immersive and projection mapping: A decade of industry projects provides repeatable templates for retail activations, museums and large-scale shows.

- Global partnership strategy: Mantong is actively seeking global business partners to expand local integration networks and support field deployment.

Products Mantong focuses on: immersive projection, interactive floor projection, interactive wall projection, interactive projection games, projection shows, interactive projection mapping and 3D projection. For integration partners, Mantong's direct manufacturing and customizable software stacks can shorten delivery cycles and simplify procurement.

Visit Mantong Digital: https://www.mtprojection.com/

How to evaluate an interactive projector project: checklist for buyers and integrators

Before procurement, evaluate projects across these dimensions:

- Objective: education, brand engagement, wayfinding, or spectacle?

- Environment: ambient light, surface type, access for maintenance.

- Interactivity needs: touch, motion tracking, multi-user support.

- Content lifecycle: who creates and updates content; need for cloud CMS?

- Service model: one-off installation vs managed service contract.

Choosing vendors that can provide proof-of-concept installations and flexible financing (lease, managed service) de-risks adoption and accelerates deployment.

Risks, uncertainties and sensitivity of the forecast (interactive projector market)

Main risks that could alter the 2026–2030 forecast:

- Faster-than-expected price declines: would compress hardware revenue but may accelerate unit adoption.

- Content bottlenecks: demand can be limited by lack of high-quality interactive content or local integrator capacity.

- Economic cycles: capital-intensive events and retail experiential budgets can be volatile in downturns.

- Competitive display technologies: LED micro-displays and AR headsets could shift some use cases away from projection over time.

We recommend continuous monitoring of ASP trends, software attachment rates, and education procurement budgets to refine forecasts yearly.

Practical recommendations for stakeholders in the interactive projector market

For suppliers:

- Bundle software and services, and publish case-study ROI numbers.

- Build partnerships with regional system integrators and content studios.

For buyers and integrators:

- Run small-scale pilots to validate content workflows and interactivity models.

- Consider managed-service contracts to convert capital expenses into OPEX and enable frequent creative refreshes.

Final thought

The interactive projector market is a growth subsegment of the wider projection ecosystem. Its future size through 2030 will depend as much on content and service innovation as on hardware advances. Suppliers who convert installations into recurring content and service streams will capture disproportionate value as adoption scales.

Frequently Asked Questions (FAQ) — interactive projector market 2026–2030

1. What is the difference between an interactive projector and an interactive flat panel?

Interactive projectors create large, flexible projection surfaces and tend to be more cost-effective at large sizes or unusual surfaces (floors, curved walls). Interactive flat panels (IFPs) offer higher brightness in ambient light and often simpler touch functionality but can be cost-prohibitive for very large displays. Choice depends on size, ambient light, portability and budget.

2. How fast is the interactive projector market expected to grow 2026–2030?

Our synthesis suggests a growth range with an approximate CAGR of 7% (conservative) to 12% (optimistic) for the interactive projector subsegment through 2030, driven by education, retail and projection-mapping demand. Refer to the forecast table above for year-by-year values.

3. Which industries will adopt interactive projection most quickly?

Education (classrooms and campuses), retail/brand activations, live events/attractions, museums, and urban projection mapping projects are the leading adopters.

4. What is the total cost of ownership (TCO) components for an interactive projector installation?

TCO includes hardware (projector, lenses, sensors), mounting and alignment, software licenses (CMS, mapping), content creation, installation labor, calibration and maintenance, and optionally managed content services.

5. Should buyers prioritize short-throw or ultra-short-throw interactive projectors?

For classrooms and tight spaces, UST is often preferred for safety and space efficiency. For larger experiential installs and projection mapping, short-throw or long-throw high-brightness projectors may be required. The choice should be based on throw distance, surface, and ambient light.

6. How can I find an interactive projector supplier with system integration and content expertise?

Look for vendors that provide end-to-end solutions (hardware + software + content + installation). Mantong Digital (https://www.mtprojection.com/) is an example of a one-stop provider with manufacturing and project experience in immersive and interactive projection.

Contact, partnership and product inquiry

If you are assessing interactive projector projects, piloting an immersive experience, or seeking a manufacturing partner, Mantong Digital offers customizable projection hardware and software, project consulting, and global partnership opportunities. Visit https://www.mtprojection.com/ to view product lines and request a consultation.

References and data sources

- Digital projector — Wikipedia. https://en.wikipedia.org/wiki/Digital_projector (accessed Jun 2024).

- Projection mapping — Wikipedia. https://en.wikipedia.org/wiki/Projection_mapping (accessed Jun 2024).

- Grand View Research — Projector Market Overview (industry page). https://www.grandviewresearch.com/industry-analysis/projector-market (accessed Jun 2024).

- MarketsandMarkets — Projection Mapping / Projection Markets (industry research portal). https://www.marketsandmarkets.com/ (searchable reports) (accessed Jun 2024).

- UNESCO and education digitization trend reports — context on education technology adoption. https://en.unesco.org/themes/education-emergencies/covid-19 (accessed Jun 2024).

- Fortune Business Insights — Digital Signage/Projection related market research (for experiential retail context). https://www.fortunebusinessinsights.com/ (accessed Jun 2024).

- Industry vendor websites and product pages (for UST and interactive projector technical trends) — examples include established AV manufacturers and integrators (accessed Jun 2024).

Disclaimer: Forecasts in this article are scenario-based estimates derived from synthesis of public industry reports, vendor information and observable market trends. Readers should use the methodology and references provided to adjust assumptions for their own planning purposes.

Interactive Projection Build Cost: Full Budget Breakdown

Case Study: Immersive Projection Room for Museums and Exhibits

What is interactive projector game system ?

Maintenance, repairs and service costs for interactive floors

One-Stop Projection Solution Provider Since 2011

What about the wall/floor material for the projection?

It’s recommended to choose a light-colored material with minimal reflectivity—pure white or light grey works best. the

common material is cement & plaster board

For optimal projection results, the surface should be free of any patterns or textures, as the projector will display content

directly onto it.

There are no specific material requirements; you may use any commonly available material in your local market, as long as it

meets the above conditions.

What's the application of Immersive projection ?

It can be used in various venues, such as art exhibition, entertainment venues, educational institution, Wedding hall /Banquet/Bar,Yoga Studio and so on. It often involves advanced projection techniques, multimedia content, and interactive elements to engage and captivate the audience's senses.

What information do you need to know before making the proposal/solution?

We know that everyone wants to know the price, but the price of our products is determined by many factors since most of our products are custom, so no ready price list. In order to fast understand what you need, can you send us an inquiry like this?

For example: I am really interested in your immersive projection products, we are a company in the USA and want to install some in my restaurant. It is about 50 meters long, and 5m in width. Projection size you can decide but the length should be not less than 20 meters. We want some content about SeaWorld because our place is all about the sea. Thank you.

How to Write an Interactive-Effect Video Customisation Script ?

① Project Background: Briefly introduce the context in which this interactive scene will be used (e.g., exhibition, museum,

event space, children's area). Example: This scene is part of the “Underwater World” zone in a children's science museum,

designed to be engaging and exploratory.

②Visual Style / Atmosphere: What kind of visual mood are you aiming for? Please describe the color scheme, style, and any

references. it should focus solely on describing the visual aspects of the scene, supported by relevant charts or reference

images.

③ Interaction Points Overview:List each interactive hotspot along with the effect you'd like to trigger when the user

touches or clicks the area. example: when player touch the clownfish, it will swims away with bubble trail (animation effect)

and produce the bubble sound ( sound effect requirement )

④ Static Visual Reference:including but not limited to background image/video, a list of major visual elements (e.g., coral,

rocks, seaweed, fish), which elements should be interactive?

How to install the projection equipment ?

1) Install the projector in a suitable position. We will provide you with a hanger, which you need to fix on the ceiling with

screws.

2) Connect projectors, computers and other accessories through wires.

3) After completing the above 2 steps, we will carry out the edge blending steps. Our team can complete it through remote

control.

In general, installation instructions for each project need to be specified on a project-by-project basis. The above is for

reference only.

Amusement Rapidly Rotating Bouncing Sphere Interactive Wall Floor Projection Sports Games

Rapidly Rotating Bouncing Sphere is an interactive space where participants jump on rotating spheres. As they step on it, the spheres surface will show special interactivity

Jumping on spheres of the same color in succession causes them to pop, releasing light particles. The more consecutive jumps, the greater the reward—caterpillars appear, and eventually, all spheres of that color burst, filling the space with light and even more caterpillars.

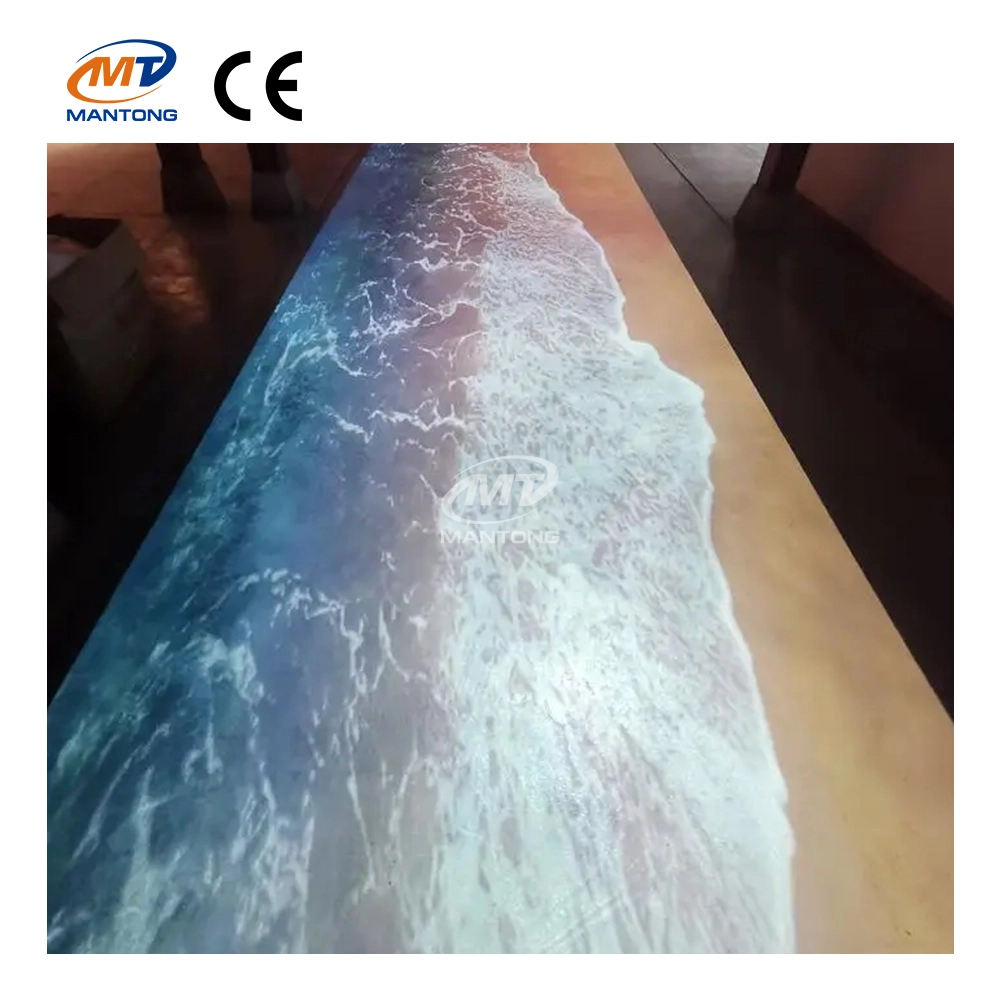

Indoor Interactive Floor Projector System - Customized Design & Installation Support

Indoor interactive floor projections display dynamic themed videos on the floor, commonly used in venues aiming to enhance brand influence or attract foot traffic, such as restaurants, hotel corridors, and brand car retail stores.

By using projectors and compatible software, the interactive content is projected onto the floor, encouraging engagement between people and the projected visuals. A single 5500-lumen indoor floor projector can cover an area of 5 m × 3 m. Typically, each project will use at least 3 units to ensure broad coverage and optimal visual effects.

We also offer customized design and installation support to enhance the interactive experience for your venue.

Mantong 6500LM High-Lumen Projector for Large-Scale Immersive Room Projection

Transform any space with Mantong's immersive projection mapping systems. Our high-lumen projectors (up to 6500 LM) and custom software create captivating interactive experiences for floors and walls. Ideal for museums, events, retail, and hospitality. Each kit includes professional ceiling mounting and 80+ pre-loaded video contents and is backed by a 12-month warranty and CE certification. We offer full customization and support to bring your vision to life.

Outdoor Projection Mapping 3D Interactive Floor Projection

Combining projection mapping with 3D interactive ground projection technology brings an unprecedented immersive experience to outdoor scenes.

ManTong

ManTong

ManTong